charitable gift annuity administration

For the testamentary CGA. We are on the leading edge of Charitable Gift Annuity research and now offer practical solutions for challenges faced by todays non-profit organizations.

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Toapply for a special permit to issue charitable gift annuities.

. Charitable gift annuities allow donors to make tax deductible contributions to a charitable organization. The base WatersEdge administration fee is 105. Charitable Solutions LLC is a planned giving risk management consulting firm.

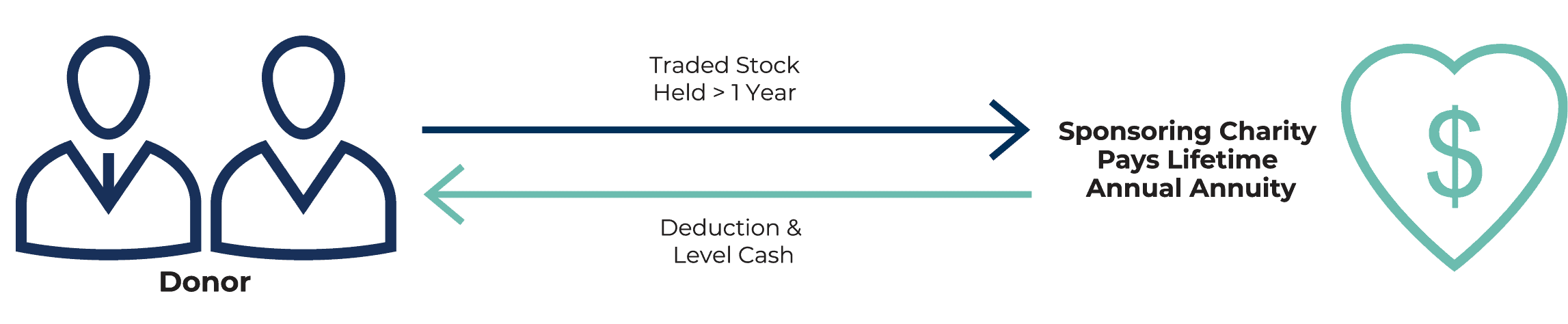

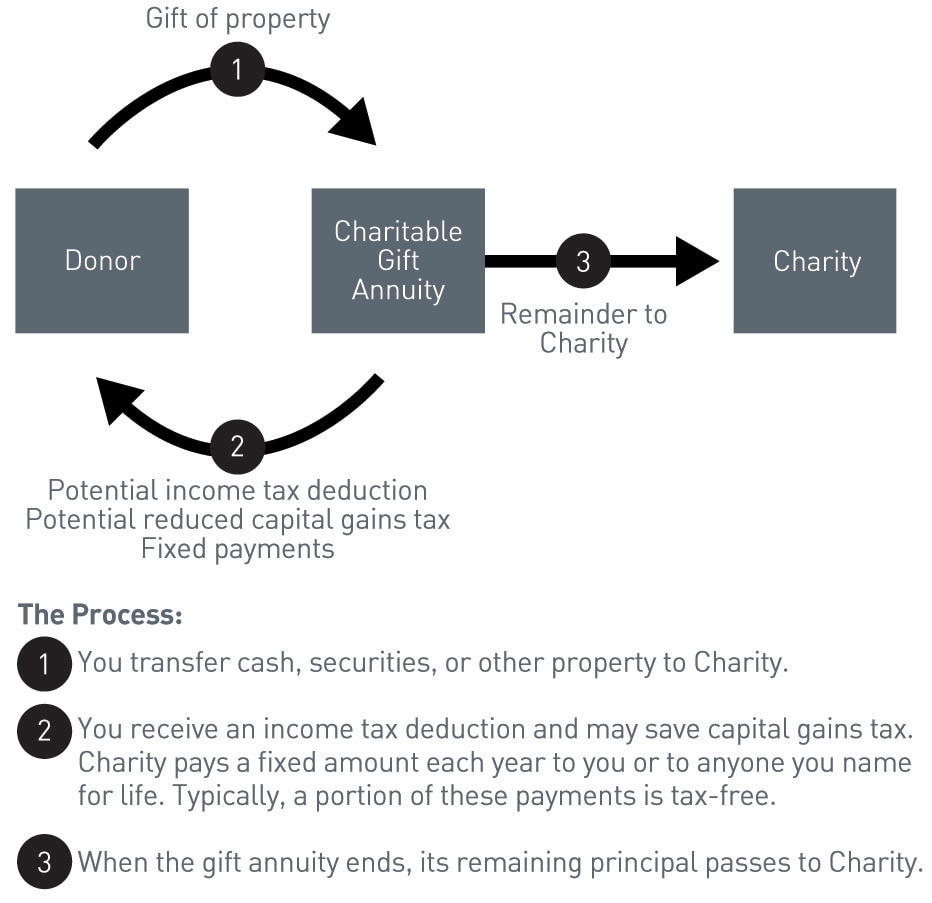

Complete all CGA administration reports. Often times we want to donate but are worried about running out of money in retirement. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

A charitable gift annuity CGA with NCF is a simple arrangement that involves a charitable gift and an annuity. In exchange for a gift of assets ie cash stock bonds real estate etc the. Support the area of Duke most meaningful to you.

FASB 116 and 117. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Our program is dedicated to serving.

The charitable deduction would be the excess of the funding amount of the CGA over the present value of the annuity the value to the annuitant. We tailor our services to. In exchange the charity assumes a legal obligation.

In exchange for the charitable contribution donors receive a stream of regular. We offer comprehensive affordable gift annuity administration for your charitable organization freeing you to concentrate on other tasks. Enjoy charitable deductions and other tax-saving opportunities.

As with any other. There is an additional fee of 50 for charitable gift annuities and its proceeds fund an annuity reserve fund that guarantees. A Charitable Gift Annuity is a contract between a donor and National Catholic Community Foundation that provides a lifetime of annuity payments to the donor and survivor or other.

A charitable gift annuity allows a donor to make a contribution to a charity in exchange for a fixed monthly income for both the donor and an optional additional beneficiary. Maintain complete accurate and confidential records for donors and other annuitants. A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization.

We focus on non-cash asset receipt and disposition charitable gift annuity risk management gift annuity. Gift Annuity Rates Table. Charitable Gift Annuity The University will establish and promote gift annuity contracts with donors in accordance with applicable federal law IRS regulations and the laws and regulations.

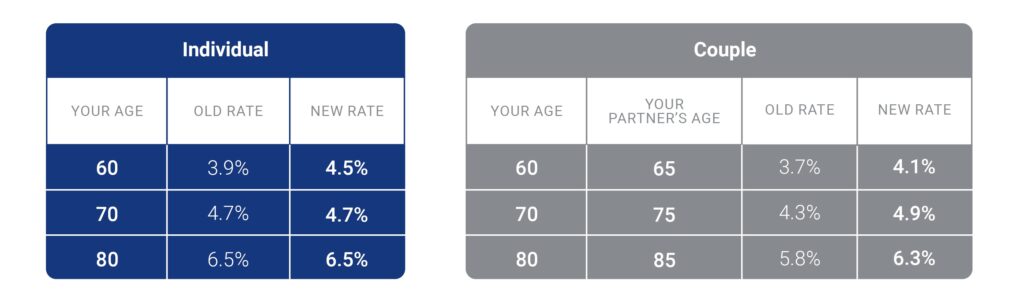

The American Council on Gift Annuities approved new gift annuity rates that became effective July 1 2003. 2022 and voted to increase the rate of. Please see the chart that follows for the current rates.

A gift annuity is an amazing way to give a gift to Doane as well as provide income for the rest of your. Establish a gift with as little as 10000. You make the gift part of which is tax deductible and then you.

Send a cover letter there is no formal application form along with the materials requested. 133 rows Annual expenses for investment and administration are assumed to be 10 of the fair market value of gift annuity reserves. Charitable Gift Annuity.

Your gift to Duke establishes.

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuity Tax Deductions Cga Rates Ren

Less Is Often More Tax Issues With Charitable Gift Annuities

Act Now Charitable Gift Annuity Rates Have Increased Giving To Duke

Charitable Gift Annuity Catholic Community Foundation

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuities Gifts That Give Back Hillel

Simple Steps To Start And Grow A Gift Annuity Program

Gift Annuity Administration Services Crescendo Interactive

Key Differences Between Charitable Gift Annuities And Endowments Pnc Insights

Charitable Gift Annuities Kqed

Gift Annuity Acga Rates Crescendo Interactive

Gift Annuity Administration Software Crescendo Admin Crescendo Interactive

Charitable Gift Annuity Licensing Compliance In Maryland Harbor Compliance

Charitable Gift Annuities 1 Introduction Youtube

How Does A Charitable Gift Annuity Work Blog American Bible Society News